Is your product at risk of Product Market Fit Collapse?

Why are some companies vulnerable to AI disruption while others stand on solid ground? This question is critical—not just to help you understand the risk—but to help you figure out how to respond.

Chegg's 87.5% valuation drop. Stack Overflow's traffic decline. These are early examples of Product Market Fit Collapse, but there will certainly be more cases as AI roils established markets. Several early AI darlings—like Jasper and Tome—have had to shift strategies to deal with intense competition. Incumbents like Adobe have moved fast, closing off the window of opportunity that AI‑first design startups hoped to exploit.

Others remain insulated, at least for now. Airbnb’s CEO, Brian Chesky, says weaving AI into the product will take years. Clearly, they aren’t facing imminent threat from the Gen AI boom.

So, why are some companies vulnerable while others stand on solid ground?

That's exactly what we built the AI Disruption Risk Assessment to answer. In our latest Reforge post, Brian Balfour and I break down this framework from our AI Strategy course.

The AI Strategy course is available on-demand now,

with our next live cohort starting October 2025.

We ran the first cohort in April, and participants loved this assessment. It cut through the noise and showed them exactly where their company stood—and where they needed to go. They wanted to bring it back to their teams.

Consider this post an amuse-bouche—a little taster to get you started. Check out the full Reforge post for all the deets.

Customers are “divinely discontent”

Historically, the bar for Product Market Fit raised gradually over time. Jeff Bezos once wrote in a shareholder letter:

That was in 1998.

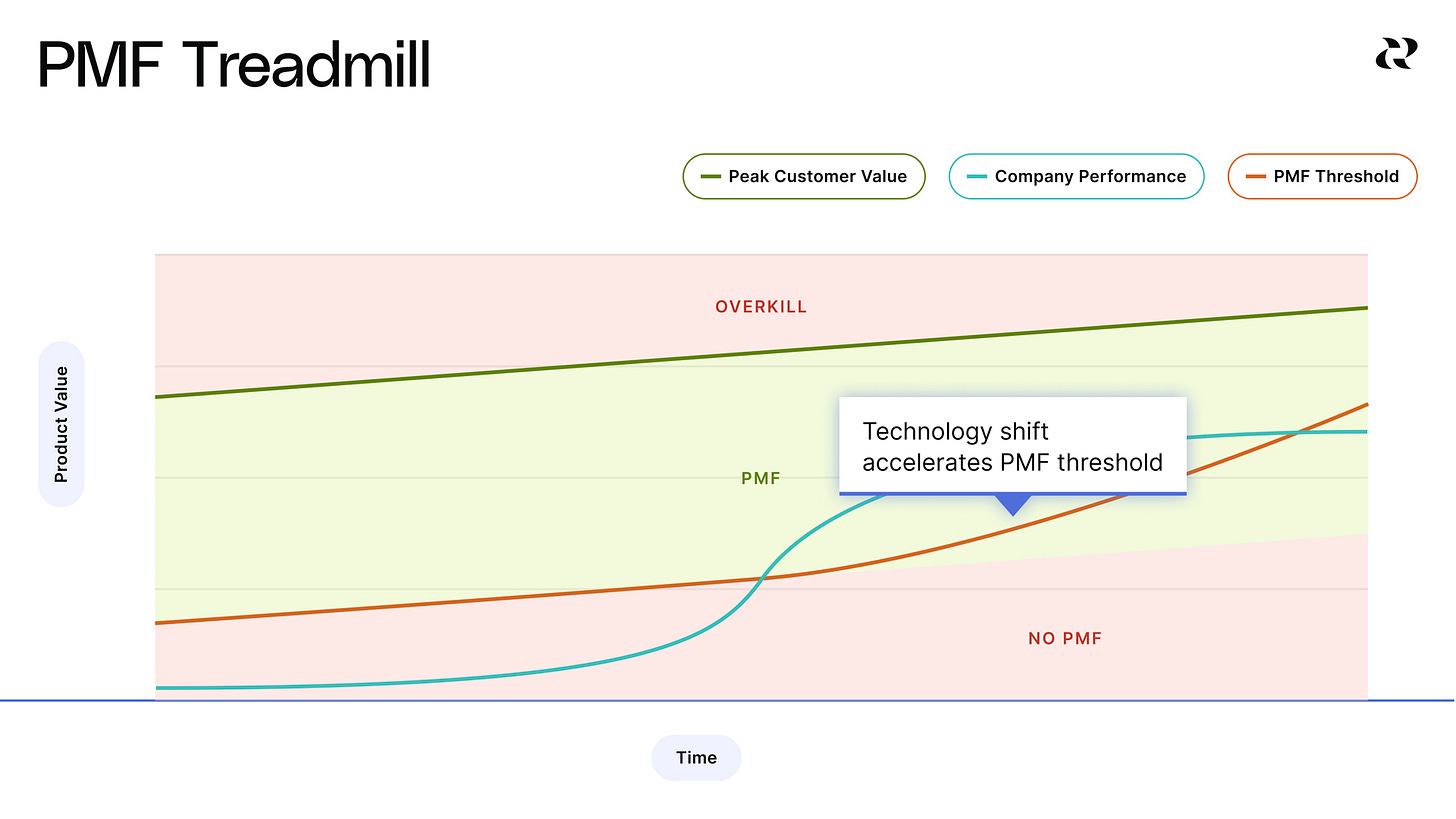

In the Reforge Product Strategy program, Casey Winters and Fareed Mosavat describe this as the Product Market Fit Treadmill. During a technology shift, the PMF threshold (the red line) accelerates:

In this past, this acceleration happened over time, primarily because of “technology diffusion”. In other words, it took time for people to come online or get mobile phones. The diffusion of AI technology is much more rapid. It took ChatGPT just 5 days to reach 1 million users.

Customer expectations aren’t rising at a predictable, linear pace over longer periods of time—they are spiking nearly instantly. This creates Product Market Fit Collapse, a phenomenon unprecedented in the history of tech.

How to tell if your product is at risk

The AI Disruption Risk Assessment consists of 18 distinct factors in 4 risk areas:

Use Case - How will AI impact how users engage with your product?

Growth Model - How will AI impact your product’s growth model?

Defensibility - How will AI impact your product’s defensibility?

Business Model - How will AI impact how your product monetizes?

No single factor dictates whether your product is or is not at risk. Instead, you’ll evaluate how your product stacks up in each of these factors.

To help with your evaluation you can use the AI Disruption Risk Tool, an online tool that was “vibe coded” using v0.dev with a single prompt.

Sidebar: I was astonished that v0 was able to build the tool with a single prompt. I uploaded the right lesson from AI Strategy and asked:

This document describes the AI Risk Assessment Framework, a tool that product managers can use to assess how at risk their product or company is of disruption by AI. Based on this document, generate a single page for segmented into four sections: Use Case Factors, Growth Model Factors, Defensibility Factors, and Business Model Factors. In each section, include a row for each factor that includes the Factor and the Description. On that same row, include 7 radio buttons that let a user select from Low Risk to High Risk. Include the Low Risk and High Risk descriptions under labels on the left (Low Risk) and right (High Risk) side of those buttons.All buttons should be set to the middle value 4.

Include a AI Vulnerability Score that updates as the user makes their radio button selections. Sum the score on each row (from 1 to 7) to calculate the AI Vulnerability Score. Indicate the numeric score and a classification of Low Vulnerability, Moderate Vulnerability, or High Vulnerability.

Done in about 10 minutes — a fully functional tool built in less time than it would have taken to make a Google Sheet.

Evaluating Use Case risk

Customer expectations shift during technology transitions, and understanding how these changes impact your product requires looking at the fundamentals of how and why people use what you've built.

The difference between vulnerable and resilient isn't random. It comes down to eight key factors that determine whether your product can withstand AI disruption or becomes another casualty as incumbent products subsume more and more use cases.

Primary Workspace vs. Adjacent Tool — Core work happens in primary workspaces; adjacent tools get replaced first

Outlier Output vs. Commodity Output — Exceptional quality creates defense; "good enough" can be replaced by AI

Human Judgement vs. Pattern Recognition — Nuanced decisions resist AI; predictable patterns don't

Hard to Automate vs. Easy to Automate — Creative, contextual work survives; structured tasks get automated

Conservative vs. Tech-Forward Customers — Early adopters switch fast; conservative users provide buffer time

Human Relationships Matter vs. Irrelevant — Personal connections create moats; outcome-focused customers readily switch to AI

Varied vs. Consistent Output — AI excels when variation adds value; strict consistency requirements expose AI's weakness

Frequent vs. Infrequent Use — Habits require 10x improvements to break; forgotten products are vulnerable to new, AI-native players

Evaluating Growth Model risk

Some companies are watching their distribution channels crumble. Search gets disrupted, growth loops break down, and AI strips away the incentives that once drove user participation. Others are hitting the accelerator. AI supercharges their sharing, collaboration, direct customer relationships, and sales motions.

The difference comes down to how dependent your growth model is on systems that AI is actively dismantling versus strengthening. Products built on search traffic and user-generated content face headwinds, while those with direct relationships and human-centered growth loops often find tailwinds.

Stable vs. Disrupted Distribution Channels — AI is reshaping search, social, and content discovery; SEO-dependent businesses face the biggest risk

Intact vs. Weakened Growth Loop — UGC platforms lose contributors when AI provides instant answers; sharing and collaboration loops stay strong

Direct vs. Mediated Customer Relationships — Direct relationships build resilience; third-party dependencies create vulnerability when those channels shift

Evaluating Defensibility risk

AI is rewriting the playbook. Moats that seemed impenetrable are evaporating overnight. Years of carefully curated user content? AI swallowed it whole during training. Search traffic? Users are bypassing Google entirely. Content advantages? Gone the moment AI can match your output in seconds. The winners aren't clinging to obsolete defenses—they're building new ones around data AI can't touch, emotional engagement it can't fake, and switching costs it can't dissolve.

Proprietary vs. Public Data — AI commoditizes publicly available information; only unique data creates lasting advantage

Data-Driven vs. Content-Driven Value — Personalized experiences built on unique data stay protected; generic content gets crushed

Emotional Engagement vs. Functional Utility — AI easily replaces functional tasks; emotional experiences are harder to replicate

Strong vs. Weak Network Effects — Some network effects (like those based on human interaction) remain durable, while others (like UGC loops) are rendered obsolete

High vs. Low Switching Costs — Users stick with products when switching is challenging or costly, and they’ll try out new AI entrants if friction is low

Evaluating Business Model risk

Finally, AI isn't just changing how products work—it's rewriting how they make (and spend!) money. Per-seat pricing suddenly makes no sense when one person can do the work of five. On top of that, compute costs pile up with every power user. You're selling fewer seats while spending more per customer.

The winners? Companies with fat margins who can absorb the hit and keep experimenting. The losers get caught in a vice: rising AI expenses on one side, customers comparing their enterprise tool to $20 ChatGPT on the other. No wonder smart companies are ditching seat-based models entirely.

Value-Based vs. Per-Seat Pricing — Value-based pricing captures AI productivity gains; per-seat models lose revenue as AI reduces headcount needs

Strong vs. Weak Unit Economics — Healthy margins absorb AI compute costs and enable experimentation; thin margins handcuff innovation

Putting it all together

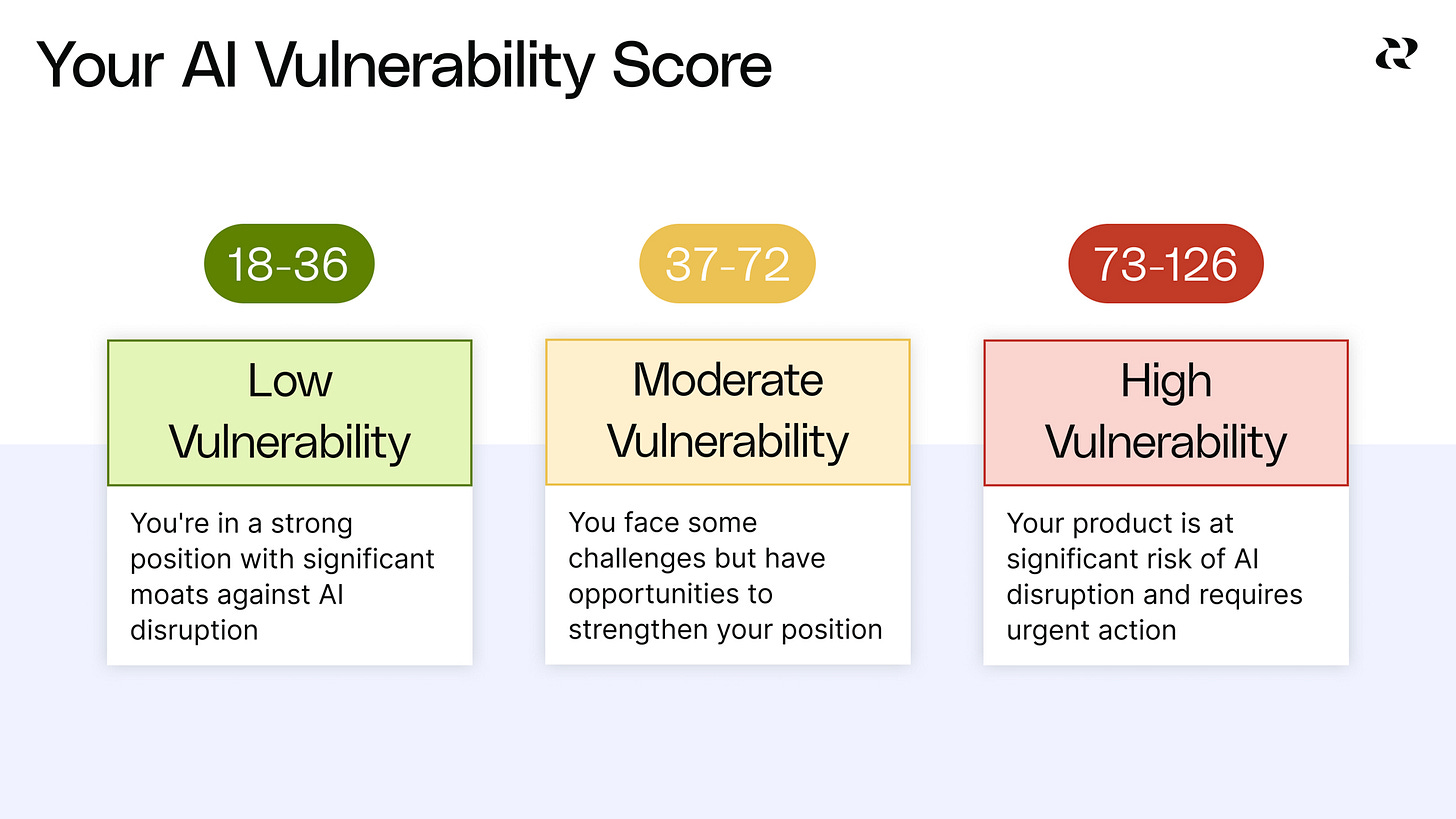

After evaluating all 18 factors, add up your scores to calculate your overall vulnerability:

18-36: Low Vulnerability – Strong position with significant AI moats

37-72: Moderate Vulnerability – Some challenges but defendable

73-126: High Vulnerability – Significant risk requiring urgent action

Your total score is just the starting point. Focus on any factor where you scored 5 or higher—these are your most pressing vulnerabilities and should drive your AI strategy.

Stack Overflow: A case of Product Market Fit Collapse

Software developers routinely run into roadblocks—those hard-to-fix bugs that grind progress to a halt. For years, that meant turning to Stack Overflow for quick, reliable answers. Then, in late 2021, GitHub Copilot and ChatGPT appeared, offering faster, more personalized guidance. Almost overnight, the steady river of visits began to recede. The problem developers face hasn't changed, but the solution shifted—from Stack Overflow's Q&A forum to AI assistants that live right in their code editor.

Stack Overflow's assessment reveals why this disruption hit so hard. They scored high-risk across critical factors: an adjacent tool serving commodity content to tech-forward users who jump ship fast. Their growth model relied on search traffic and user-generated content—both now disrupted by AI. Most damaging, their value proposition depended on public data already in AI training sets. When developers could get instant answers without leaving their workspace, Stack Overflow's loop broke. Companies with this many vulnerabilities can't wait and see—they need to move before their window closes.

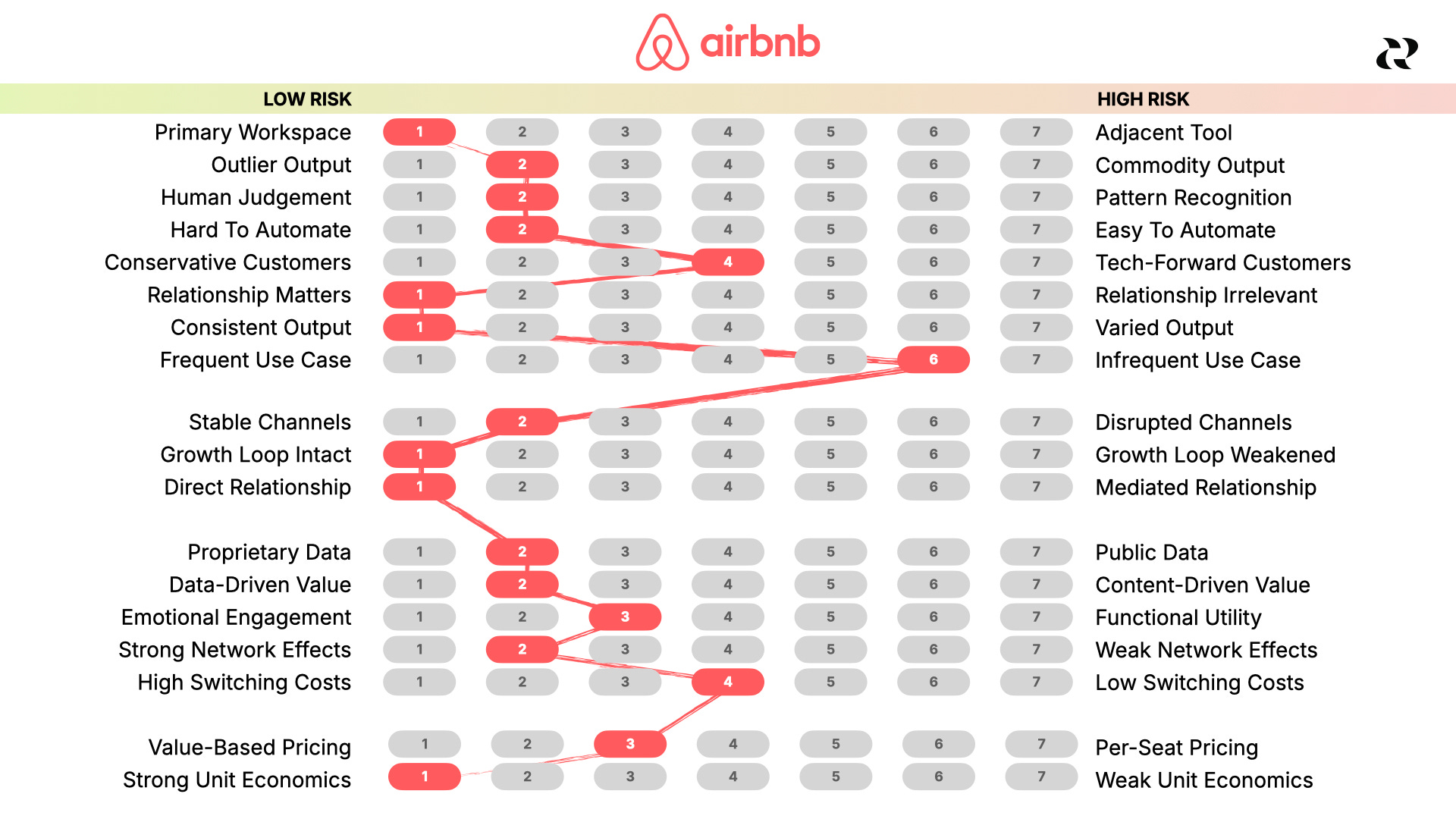

Airbnb: Taking their suite time

Airbnb tells a different story entirely. While Stack Overflow immediately felt the heat from AI, Airbnb's CEO Brian Chesky calmly announced that weaving AI into their product would take years. That's not denial—it's confidence born from a fundamentally different risk profile.

Airbnb's assessment reveals why they can afford this measured approach. They score low-risk across most critical factors: a primary workspace where relationships matter deeply, serving customers who value human connections. Their growth model relies on direct relationships with hosts and travelers rather than search traffic or content loops that AI can easily disrupt.

Most importantly, their core value comes from real-world experiences and human trust—things AI can enhance but never replace. Companies in Airbnb's position have the luxury of strategic patience, using AI to improve their platform rather than racing to avoid obsolescence.

Where do you stand?

We're at the beginning of the AI technology shift. As AI accelerates, customer expectations will rise to match. The rules have changed, and most leaders aren't ready. The AI Disruption Risk Assessment is your first step—showing exactly where your product stands today so you can build the strategy you need for tomorrow.

In the AI era, standing still means falling behind.

If you want to dive deeper, Reforge's AI Strategy program is designed for this moment. It gives you the tools, frameworks, and strategic insight to not just survive the AI shift—but to lead through it.