Great strategy gives you permission to say "no"

Poor strategy turns every shiny object into a distraction. Great strategy makes it easy to stay ruthlessly focused.

This is a guest post by Tim Herbig, author of Real Progress—a practical guide to escaping “Alibi Progress” and defining product strategy that actually creates value.

Tim invited me to read an early copy, and I was struck by how clearly he’s distilled years of hard-won lessons into a coherent framework. His Progress Wheel is the best unified theory I’ve found for how all the pieces fit together—defining the right strategy, setting meaningful goals, and reducing uncertainty through discovery. It captures what I’ve seen work with high-performing teams: ruthless focus on what matters, not just what looks impressive. If you’re tired of roadmaps that are really just to-do lists, check out Real Progress.

Stephanie, an experienced Director of Product, nervously walked into the strategy presentation meeting. After weeks of meticulous preparation, she was finally ready to present the revamped product strategy for GearSwap, a marketplace for outdoor gear and equipment, to the C-level. Strategy had always felt hard to grasp for her, so she stuck to the templates that seemed bulletproof.

As she walked the executives through the structure, she felt a weight coming off her shoulders. Many nodding heads and few critical questions made her confident in her choices. In essence, her Product Strategy conveyed this message:

“The GearSwap marketplace will proactively help weekend warriors and professional adventurers alike to match trip challenges with the right gear. They will benefit from peer-to-peer and professional seller options across all outdoor categories. Buyers will choose us because of community trust and expert curation, while sellers prefer the additional marketing tools we provide for them to go beyond their existing sphere of influence.”

All the fields of her chosen canvas had information in them and connected with the company’s Mission to “Equip outdoor enthusiasts with the gear they need.” Leaving the room, Stephanie looked forward to revisiting the product organization’s roadmap items and prioritizing them according to this strategy. After all, they would have clear guidance on what to work on beyond opportunistic customer problems or sales requests.

Two weeks later, Stephanie and her team sat down for a prioritization meeting. In it, several external requests came up from different sources:

A competitor had launched a gear insurance offering, including services such as on-site 12-hour replacement of damaged equipment.

One of the largest resellers on their platform requested an integration with their custom warehousing software.

Across customer support requests, the search for water sports equipment surfaced (pun intended). Should they go deep into this vertical?

Stephanie thought, “Well, that’s what our new strategy is for,” and she and her PMs worked through the requests, aligning them with their product strategy. Instead of clarity, they found endless ways to craft a narrative that linked each of these requests to their strategy.

Insuring gear wasn’t per se misaligned with their strategy. Facing a broken gear on a trip could be a real problem that their buyers seemed to experience. But…was it one they wanted to solve?

They wanted individuals and companies to be sellers on the platform. To protect their inventory, they likely have to fulfill this request from the global reseller, despite their warehousing software having numerous technical quirks to deal with.

What Stephanie and her team experienced was what I like to call Alibi Progress: A strategy that ticked the boxes of a given template or canvas, but failed to create value for the teams creating it in critical decision-making moments. To prevent that, we need to revisit our product strategy and return to the basics.

Why product strategy must be decisive

Amidst all the fun templates and processes, it’s easy to overlook WHY teams need product strategy in the first place and what it’s supposed to do.

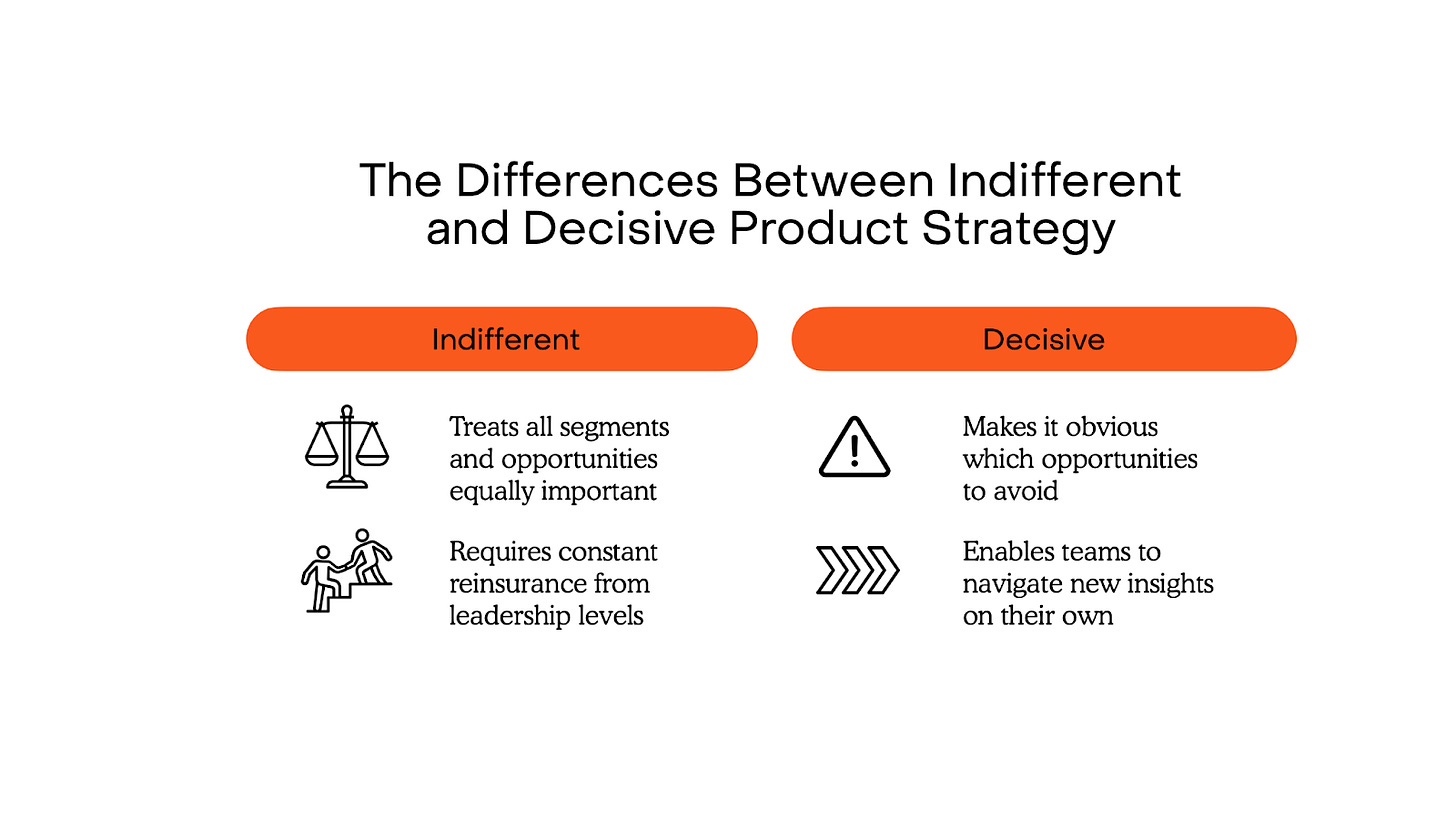

I like to summarize it as “Product strategy is about enabling a team to confidently say yes or no to opportunities coming their way over the next 6 - 18 months.”

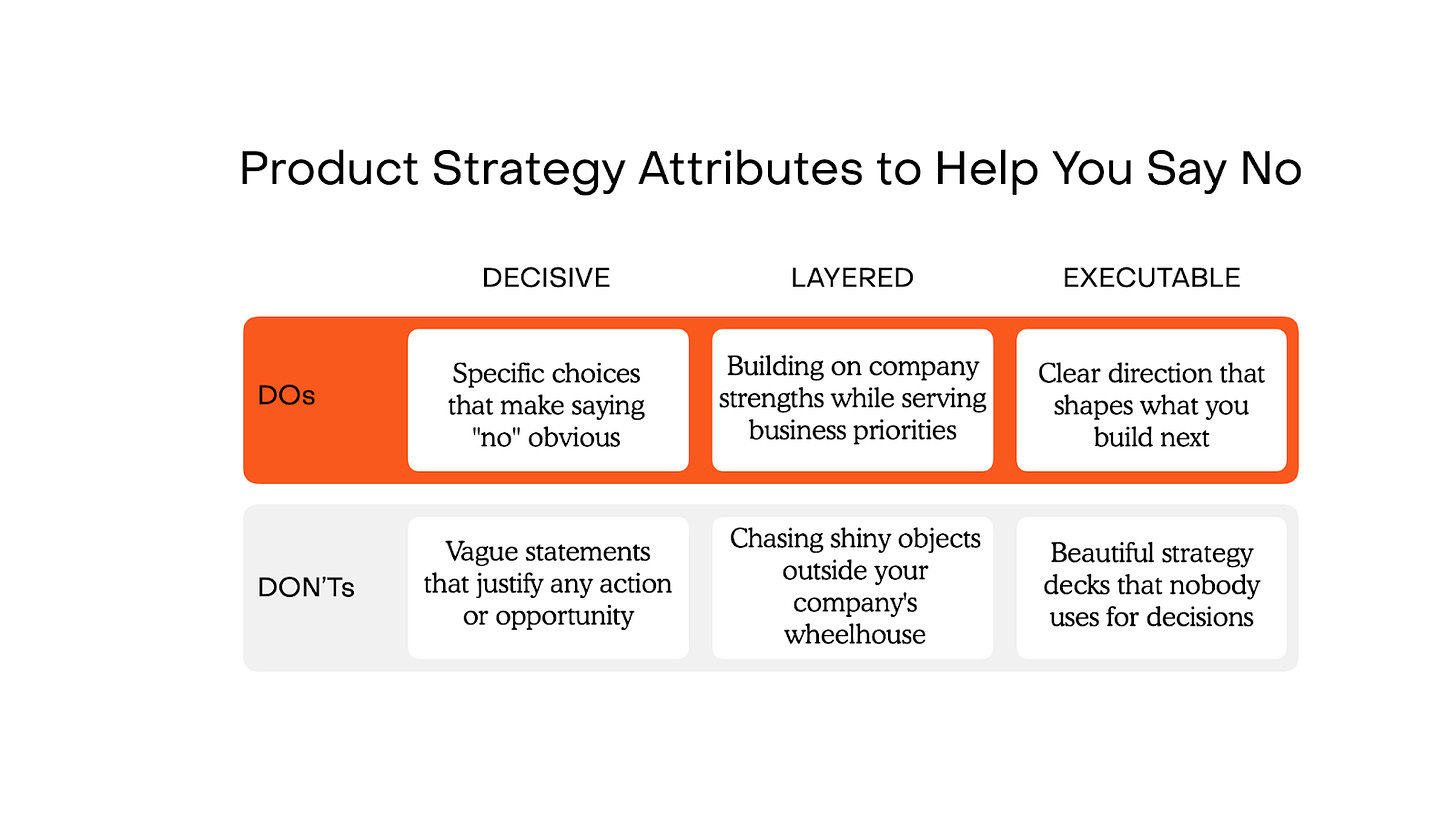

And instead of universal “good strategy/bad strategy” definitions, I believe in the power of contextual guidance to improve practices. In the case of product strategy, I believe its value comes from paying attention to three attributes:

Valuable product strategy requires three attributes: being decisive (making clear choices), layered (connecting to company strategy), and executable (translating into daily decisions). This article focuses on the foundation: decisiveness. Without it, even well-layered and executable strategies become justification machines rather than decision filters.

We will revisit how Stephanie’s product strategy guides execution by deriving actionable goals. Let’s assess why its lack of decisiveness made it difficult to prioritize stakeholder requests and market observations.

The consequences of indecisive strategy

Instead of treating product strategy as a monolith that you have to make more decisive all at once, consider it a cohesive machine with different dials to turn. In essence, you have to make choices across a few core questions that the strategy needs to answer:

Why do you want to act now, and what long-term ambitions drive your actions?

For whom do you want to solve problems, and what are these problems? Who else tries to solve that problem?

How do you plan to reach your audience? What makes them choose you over an alternative?

The answer to each of these questions represents a choice. And the specificity of each choice influences how decisive, and therefore practical, your product strategy will be.

In GearSwap’s case, their answers to these questions simply weren’t specific enough:

Why do you want to act now, and what long-term ambitions drive your actions?

Their Answer: “Proactively help match trip challenges with the right gear”

The Problem: This describes what the product does, not why it matters now. Without urgency or market insight, every request can claim to “help match challenges”—providing no prioritization basis.

For whom do you want to solve problems, and what are these problems? Who else tries to solve that problem?

Their Answer: “Weekend warriors and professional adventurers alike benefit from peer-to-peer and professional seller options across all outdoor categories.”

The Problem: This serves everyone with everything. Weekend warriors want convenience; professional adventurers need specialized reliability. Both buyer segments could want gear insurance. All seller types could justify the warehousing integration. When the strategy never chooses an audience or category focus, the team can’t choose either.

How do you plan to reach your audience? What makes them choose you over an alternative?

Their Answer: “Buyers choose us for community trust and expert curation; sellers choose us for marketing tools to expand their reach.”

The Problem: “Community trust” (peer-validation, anyone can list) contradicts “expert curation” (gatekeeping, quality control). “Marketing tools” is generic enough to justify any seller feature—warehousing integration, seller profiles, analytics. Without specific differentiation or distribution channels, every feature request fits.

Making these answers more specific also impacts the specificity of some of the other answers. Improving your product strategy “machine” bit by bit.

How to create a decisive strategy

Instead of trying to change the aforementioned strategic monolith all at once, consider the individual components you use to assemble your strategy choices.

Here are the different components GearSwap could sharpen to make the overall strategy more decisive:

Strategic components aren’t independent choices—they’re interconnected gears in a machine. Turn one dial, and the others naturally adjust to match.

When GearSwap narrowed its audience from “weekend warriors and professional adventurers alike” to solely “professional adventurers planning multi-day backcountry trips,” a cascade followed:

Seller focus sharpened automatically. Professional adventurers need technical gear with detailed specifications—not John Doe’s family tent from five years ago, but specialized equipment like wilderness cooking systems or technical climbing gear. This demands niche commercial sellers and experienced individual adventurers who can provide item condition details that matter for high-stakes activities.

Problems crystallized from vague to specific. Instead of generic “finding gear,” the problems became concrete: buyers need to verify technical gear meets safety standards for high-consequence activities; commercial sellers need to differentiate certified equipment from casual peer listings that can’t guarantee safety; individual sellers need to demonstrate maintenance practices that justify premium pricing.

Value propositions and differentiation evolved naturally. With a narrow audience and specific problems, “community trust + expert curation” transformed into “certified technical gear from vetted sellers with expertise-backed recommendations.” Distribution channels came into focus: niche outdoor shop websites, technical activity subreddits (r/alpinism, r/Ultralight), and discipline-specific forums (Mountain Project, Backpacking Light).

Simply by making a few parts of your strategy more narrow and thereby decisive, the rest can follow that specificity: Your value proposition becomes sharper and more connected to the components of buyers, sellers, and problem space, alternatives are more tangible and therefore more evident to differentiate from, and distribution channels can be discussed with a target audience in mind.

As an example, the product strategy could now be presented like this:

Why now / Long-term ambitions: GearSwap’s mission is to “Equip outdoor enthusiasts with the gear they need.” As large global resellers add operational complexity that small specialty shops can’t match, there’s an opening: experienced adventurers who prioritize gear expertise and safety over lowest price are underserved. These customers need a platform that connects them with knowledgeable niche sellers who understand technical requirements. GearSwap will become the trusted marketplace where expertise matters more than scale.

For whom / What problems / Who else:

Buyers: Professional adventurers planning multi-day backcountry trips requiring technical equipment.

Sellers: Niche outdoor shops and experienced individual adventurers with technical gear expertise

Problems: Verifying gear safety standards for high-consequence activities; accessing specialized equipment when needed; trusting seller expertise on technical specifications

Alternatives: Large outdoor retailer rentals (limited specialized inventory), and peer marketplaces (no safety verification)

How to reach / Why choose:

Distribution: Online presence through niche outdoor shop websites; active participation in subreddits for technical activities (r/alpinism, r/Ultralight); targeted forums for specific disciplines (Mountain Project, Backpacking Light)

Differentiation: Certified technical gear from vetted commercial sellers and experienced adventurers, with expertise-backed recommendations

Seller value: Connect niche outdoor shops and knowledgeable individual sellers with safety-conscious customers who value quality over price

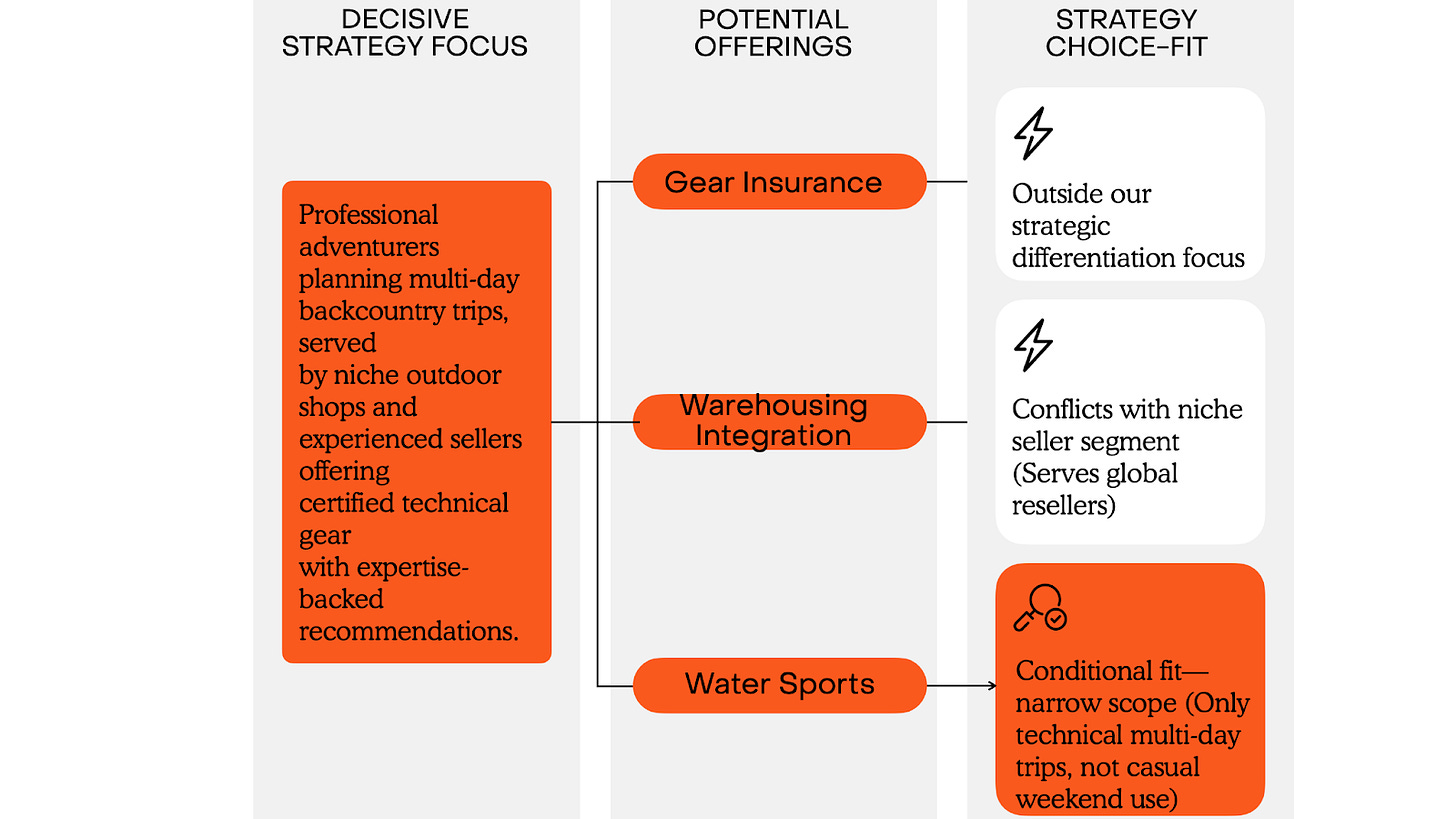

When presented with the previous requests again, the team can handle them differently:

Gear insurance with 12-hour on-site replacement:

Does this strengthen our expertise-driven differentiation? Our advantage is pre-trip confidence in verified gear, not emergency services. This adds operational complexity without reinforcing what niche sellers offer.

Decision: 🚫 Decline. Focus on seller verification systems instead.

Warehousing software integration for global reseller:

Are large global resellers our strategic seller segment? No—they’re who we’re differentiating against. This optimizes for the wrong seller type and doesn’t help niche shops showcase expertise.

Decision: 🚫 Decline. Prioritize features for small specialty sellers.

Water sports equipment vertical expansion:

Does this serve professional adventurers on technical trips? Extended sea kayaking or multi-day whitewater trips align with our expertise positioning. Casual beach rentals for weekend warriors don’t.

Decision: 🤔 Narrow scope. Only pursue technical water sports categories if niche sellers exist.

It’s not about worrying about any of these narrow choices being right. No one knows if a chosen strategy is the right one beforehand. What matters is making the call from a place of informed conviction and then putting systems in place to measure progress against these choices.

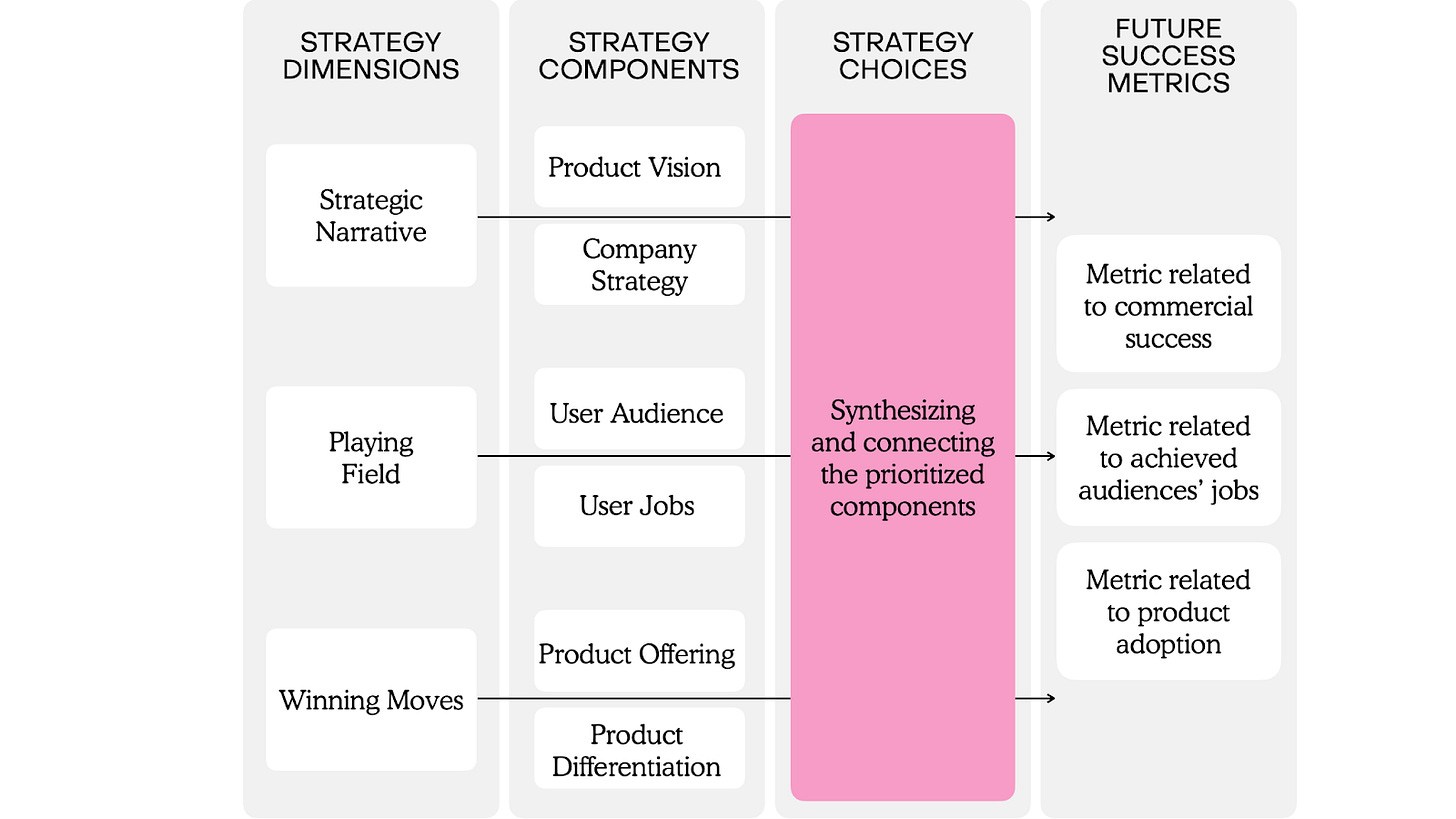

From strategic choices to strategic goals

Stephanie now has a decisive strategy. She can confidently evaluate requests against clear choices about audience, problems, and differentiation.

But strategic choices are qualitative. Daily decisions need quantitative signals. The bridge between them is a simple question:

“12 months from now, which three metrics would tell us this strategic choice worked?”

For each strategic component—your audience focus, your differentiation, your problem-solving priorities—identify the metrics that would signal your efforts serving the strategic choices.

GearSwap’s strategic translation:

The GearSwap team chooses these metrics to translate into focused quarterly goals:

Objective: Establish GearSwap as the trusted marketplace for technical backcountry gear

Key Results:

Increase multi-day trip equipment transactions from 35% to 55% of total GMV

Achieve 80% of active sellers with “outdoor specialists” verification

Reduce average gear certification time from 5 days to 2 days

Increase transaction conversion for professional adventurer searches from 12% to 20%

The connection to strategic choices is what transforms these OKRs from mere reporting tools into decision filters and progress indicators, measuring the strategy’s effectiveness and guiding future development.

Each Key Result validates a specific strategic choice:

KR1 (multi-day trip GMV) measures whether the professional adventurer audience focus is working.

KR2 (specialist verification) tracks the shift to niche sellers over casual listers.

KR3 (certification time) tests whether the safety verification differentiation can scale efficiently.

KR4 (search conversion) indicates if the expertise positioning builds the trust needed for technical gear purchases.

Now, when decisions arise, the team has both strategic criteria and progress indicators. Engineering’s algorithm rebuild? Evaluate against KR4. New seller onboarding features? Check impact on KR2. The OKRs don’t just measure—they guide.

Connecting the dots with the Progress Wheel

The connection between strategy and goals isn’t one-directional. It’s part of a larger system.

Strategy guides what to measure. But how do you know which strategic choices to make in the first place? That’s where a domain like product discovery comes in.

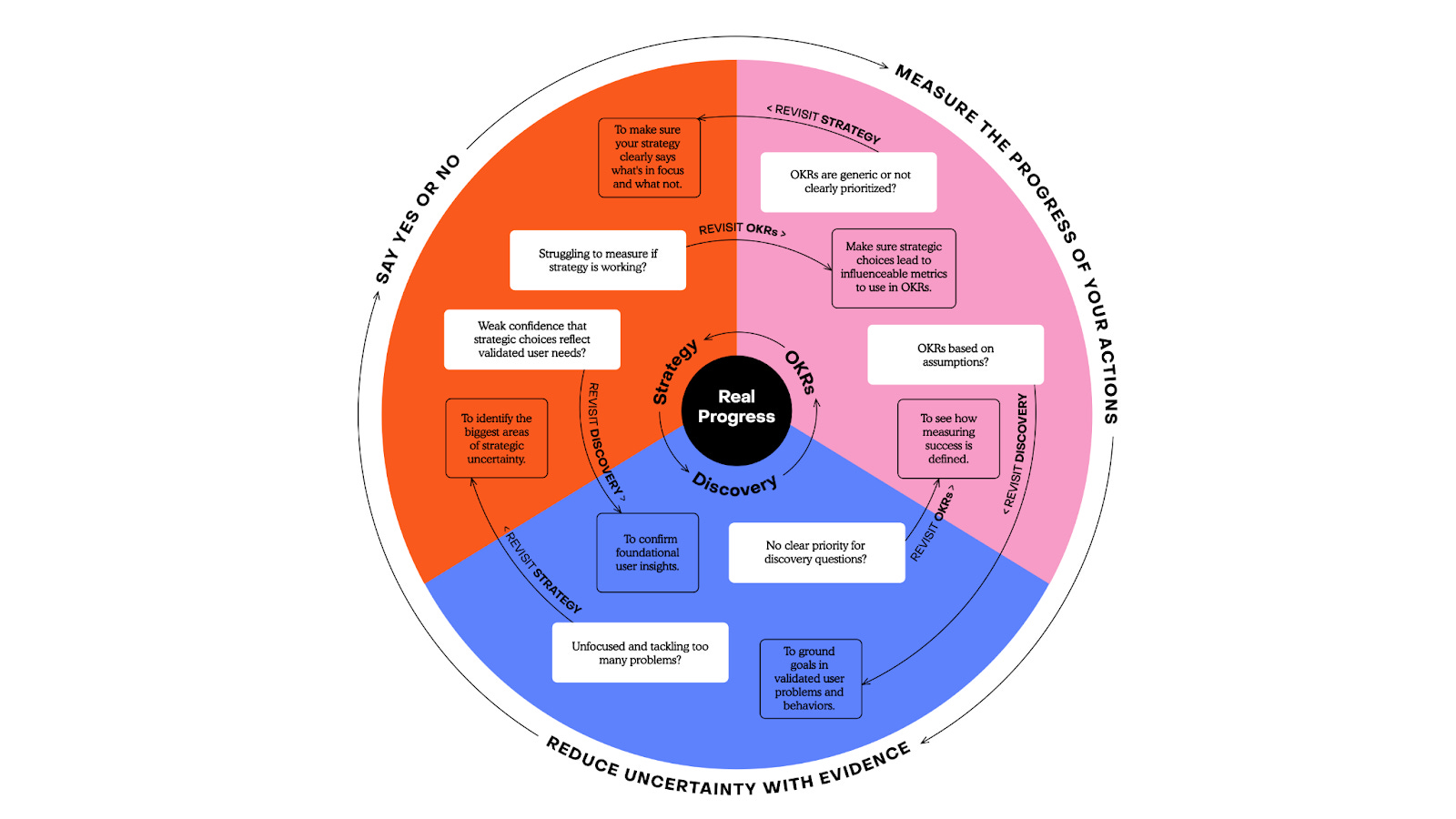

The Progress Wheel

Think of strategy, goals, and discovery as three interconnected practices that strengthen each other:

Strategy → OKRs: Strategic choices generate specific metrics worth tracking (as we just saw with GearSwap)

OKRs → Discovery: When metrics stall or surprise you, they reveal which assumptions need testing

Discovery → Strategy: Customer evidence validates or challenges your strategic choices

The cycle continues: Each practice informs and strengthens the others.

Strategy is a continuous system

Stephanie, with a decisive strategy in hand and a clear set of OKRs, embarked on the quarter. Midway through the quarter, she hit a snag. Her team committed to improving the transaction conversion rate from 12% to 20%, but they couldn’t improve the conversion rate beyond 14%.

Strategy and Goals are two legs of a three-legged stool—incomplete without Product Discovery.

Stephanie kicked off Product Discovery work to understand: “Why are professional adventurers dropping off before purchase?”

User interviews revealed something unexpected: experienced adventurers plan technical trips 6-8 weeks in advance, but most GearSwap gear isn’t listed with advance availability windows. They’re abandoning searches because they can’t plan ahead.

This discovery insight creates two ripple effects:

Immediate tactical response: Test features around advance reservations and availability calendars

Strategic refinement: The differentiation might need to evolve from just “certified gear + expertise” to include “guaranteed availability for planned expeditions”

Next quarter’s strategy incorporates this learning. Next quarter’s OKRs measure new metrics around advance purchases. Discovery continues validating whether this refined positioning resonates.

The wheel keeps turning. Strategy isn’t a one-time document. Goals aren’t just quarterly scorecards. Discovery isn’t a phase. They’re a continuous system where each practice makes the others more effective.

This interconnection—what I call the Progress Wheel—is what separates teams making Real Progress from those stuck in Alibi Progress. The details of how to strengthen each connection, what discovery methods work when, and how to time these cycles across quarters is beyond what we can cover here. But the core principle applies immediately: when you’re stuck in one domain, the answer often lies in strengthening its connection to another.

Your strategy can finally help you say no.

Your goals can tell you if that strategy is working.

And when they don’t align? That’s not a failure. It’s the signal to look deeper--to discover what your users really need.

There are so many (great) frameworks out there - like the strategy stack - still, the whole industry lacks tangible examples.

Love the approach of contrasting a decisive Product Strategy vs a weak one in a narrative. This is the meat I’ve been waiting for and missing.

Love it, thanks! Bravo!

that was a great example. Similar to what we are facing for our product strategy. thanks